Annual outlooks ahead of the last two years were about as accurate as dropping a basketball ten thousand feet from a commercial jet and swishing it through a random hoop on the ground. Thanks to the global pandemic, it was impossible for stakeholders to model their predictions off traditional cycles.

However, there appears to be more confidence this time around as the trucking industry approaches 2024 as experts lay out their assessments of what to expect in the new year.

So, what’s trucking’s prognosis for 2024?

Down and out trucking looks to rise in 2024

While very few logistics professionals will argue that the industry is normal again, most agree that market conditions have stabilized into a more predictable state. In other words, the market cycle is easier to read as it’s no longer opaque by the pandemic’s haze.

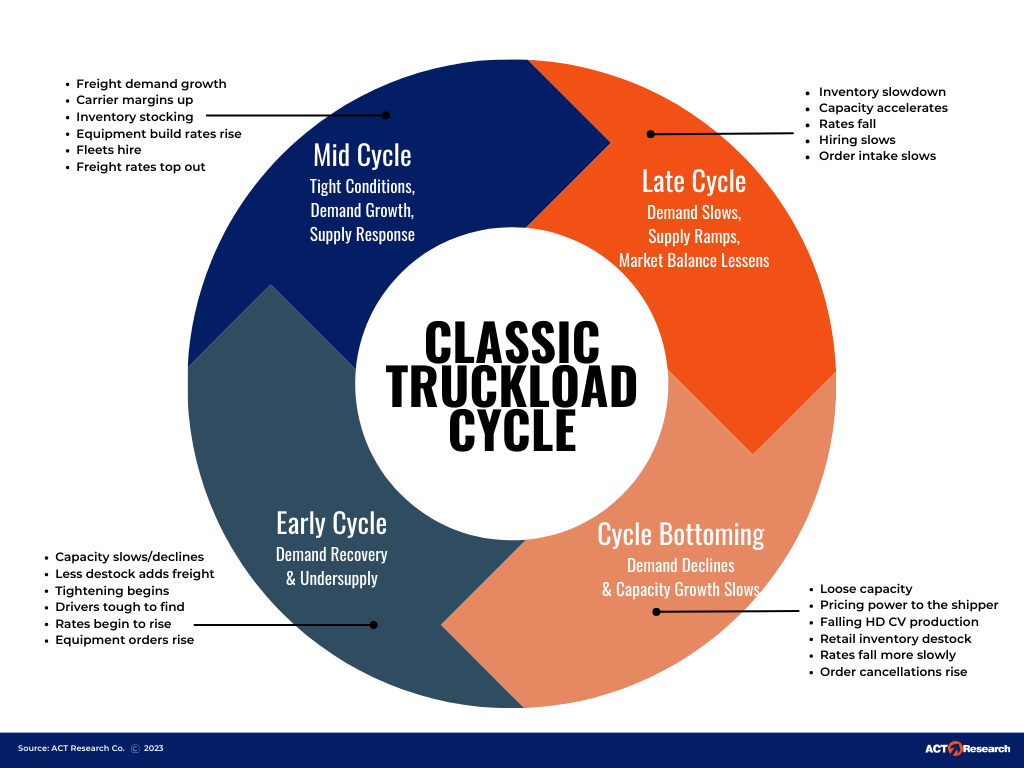

That said, trucking is presently in a “cycle bottoming” phase regarding freight demand. Right now, shipper-customer inventories are manageable with no immediate urgency to order more goods into their warehouses and storefronts. There’s no freight boom on the horizon—a far cry from 2021 and 2022.

The lack of demand for moving freight is not a new theme, either. Rather, the industry has resided in this bottom-of-cycle purgatory for the past 18 months.

As the industry enters 2024, optimistic forecasts indicate conditions are improving in favor of trucking companies, or motor carriers.

This leads to a natural question—when will the industry move into a more fruitful “early cycle” position, one where demand is recovering and capacity begins to tighten from its current state of oversupply?

Capacity looks to correct itself, but shipper demand must improve

Going into the new year, there’s a particular burden following carriers—overcapacity. There’s an abundance of available trucks all trying to secure a low amount of available freight. This imbalance benefits shippers as they’ll typically secure “all they can eat” space for favorable spot rates.

However, if the market strengthens over the next few months, the situation would correct itself. In return, capacity would tighten and force spot rates to move up, a hope of and benefit to carriers.

Of course, in order for this to happen, shipper demand must improve. This doesn’t require an emphatic boom, like in yesteryears, but rather a robust, steady, level of freight volume. At that point, trucking would relocate to the “early cycle”, finally removed from its current bottom phase.

Final Thoughts

The question above asked when, however. When will trucking get out of its bottom-of-cycle rut?

That’s where the uncertainty resides in this year’s outlook. Some experts anticipate increased freight activity from this year’s holiday season will carry momentum into the new year and usher in market improvements, while more conservative ones suggest it could take a lot longer into 2024 before such progress is made.

Contact one of our team members if you have any questions regarding this topic or any others in domestic logistics.

More blogs similar to this:

Recent Comments